USD virtual IBANs for platform flows

Run USD collections and payouts through named accounts. Clear via ACH, Fedwire, and SWIFT from one integration.

What you run in USD

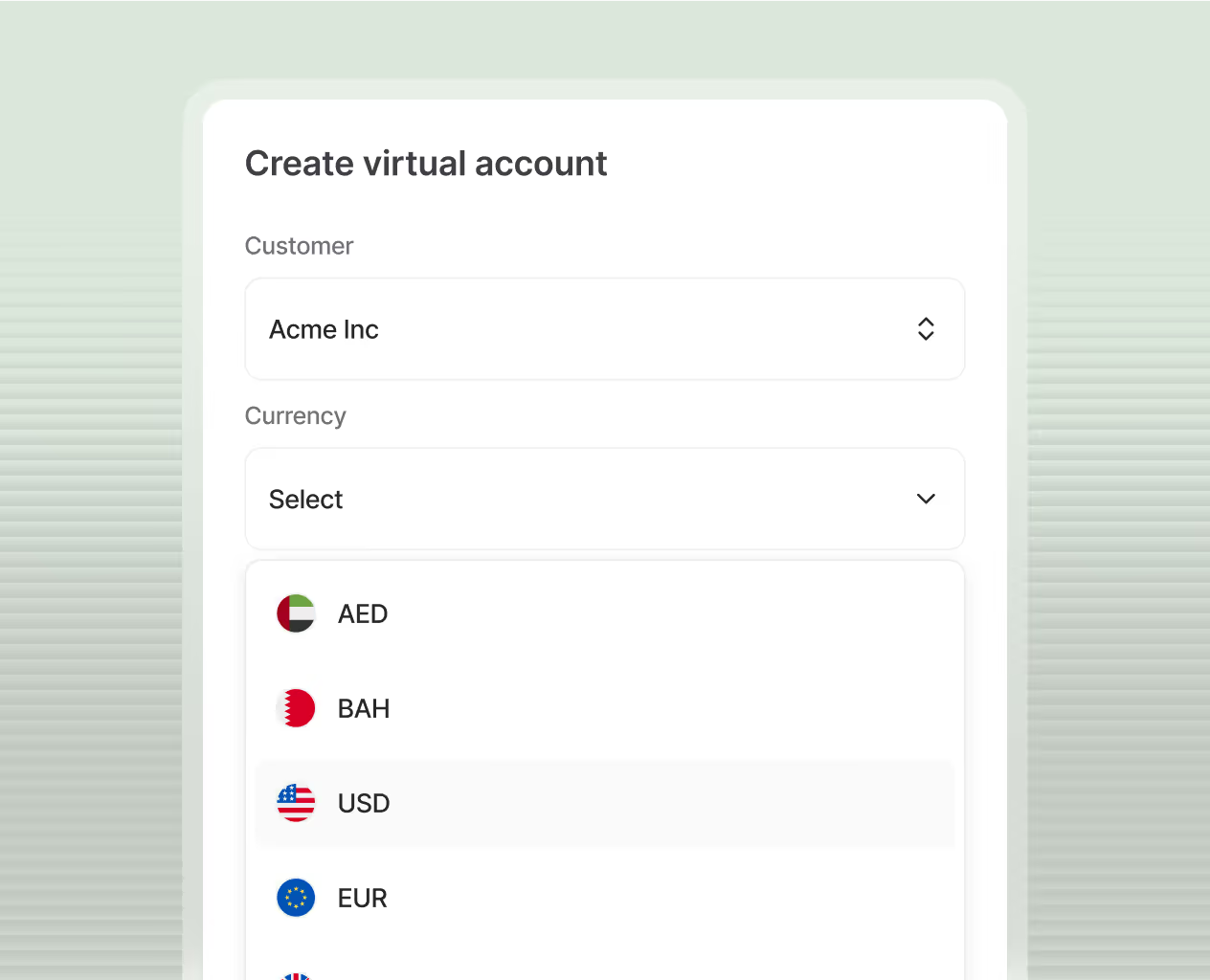

USD collections

Receive USD into named accounts for each merchant, client, or user.

USD payouts

Send USD payouts with traceability and clean status updates.

Account-level segregation

Separate client money from operating funds with clear controls.

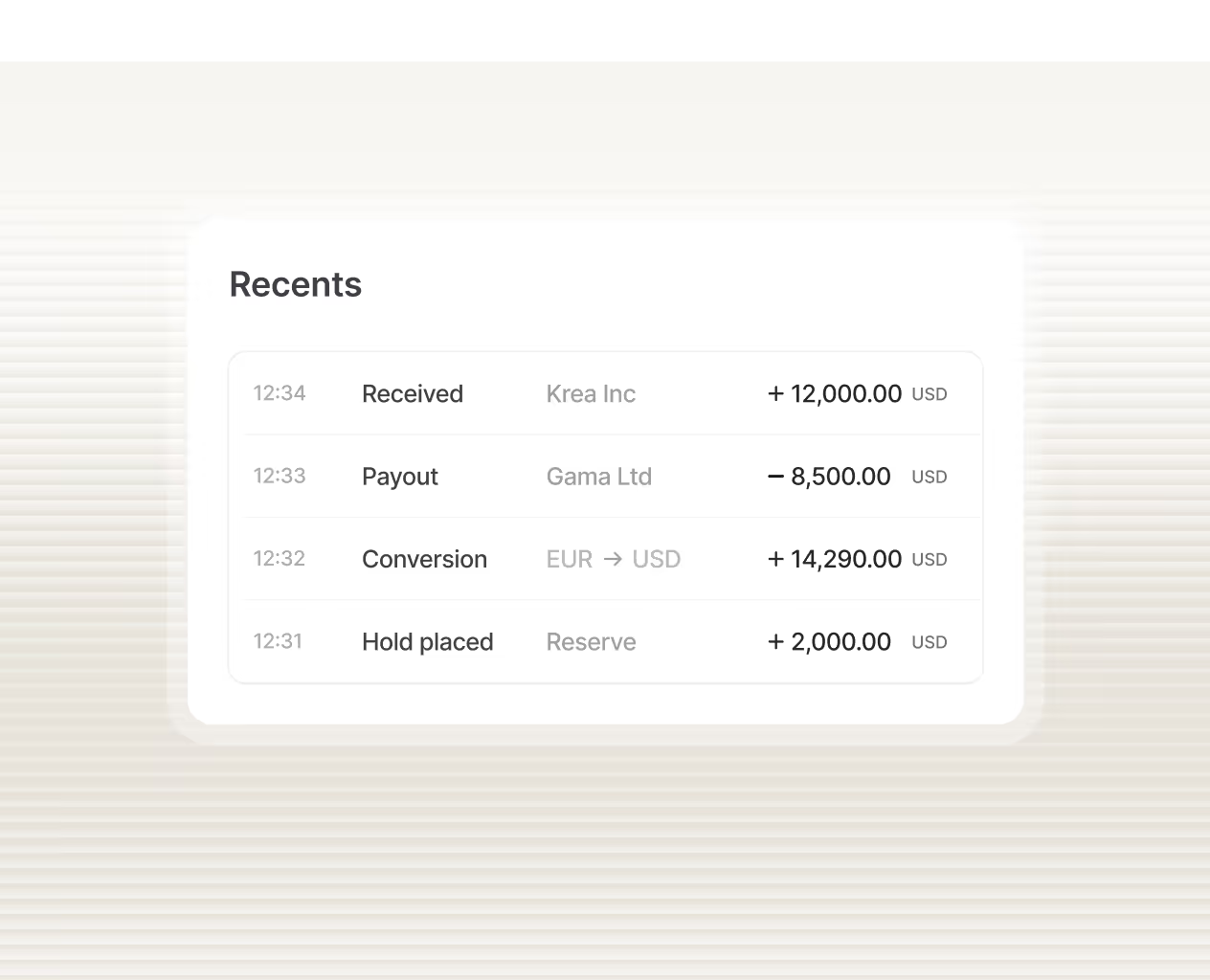

Ledger-ready reconciliation

Match every movement to the right account and reference.

Rails supported

ACH

For domestic USD clearing

Fedwire

For high-value USD transfers

SWIFT

For cross-border USD routing

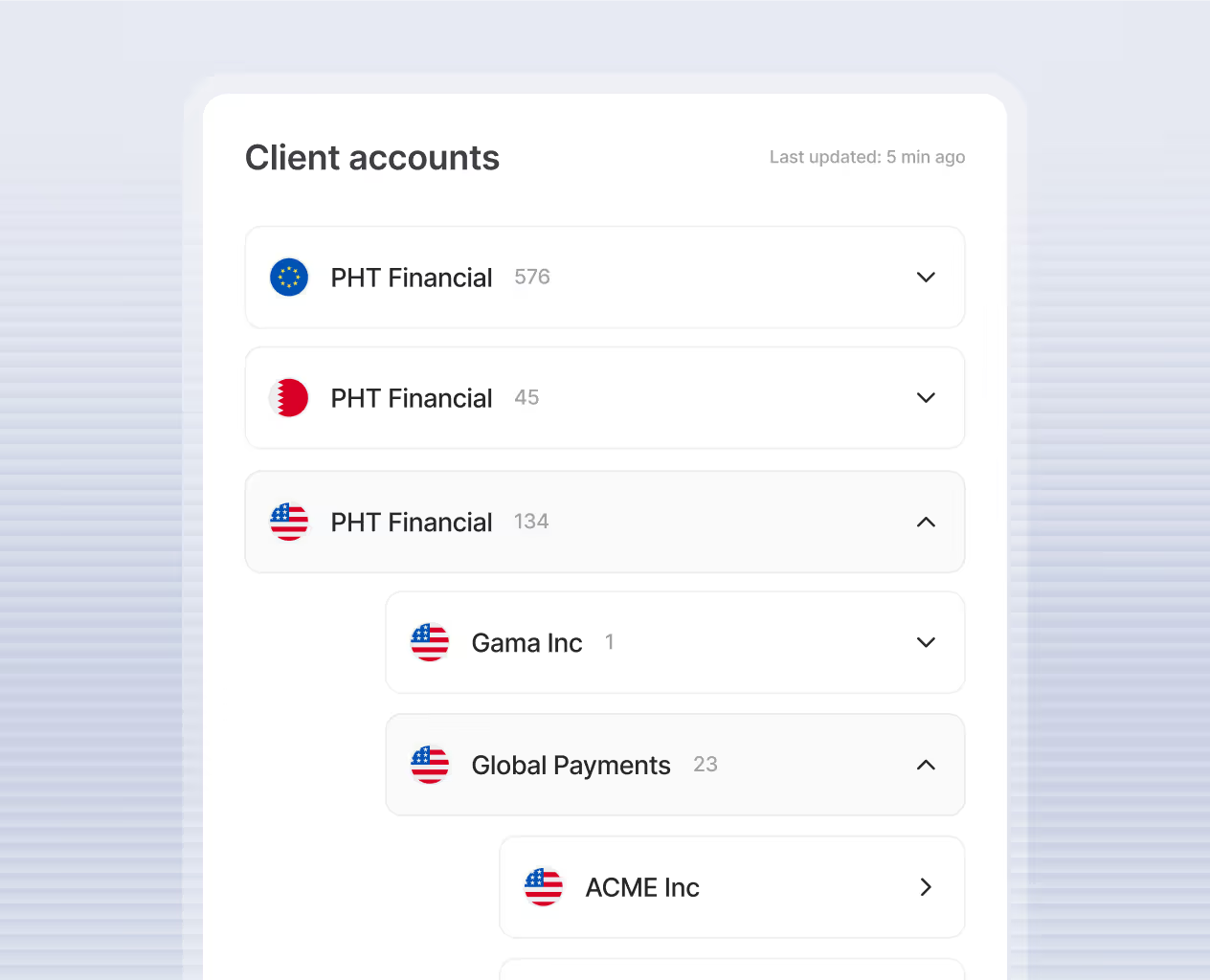

How it fits into your account structure

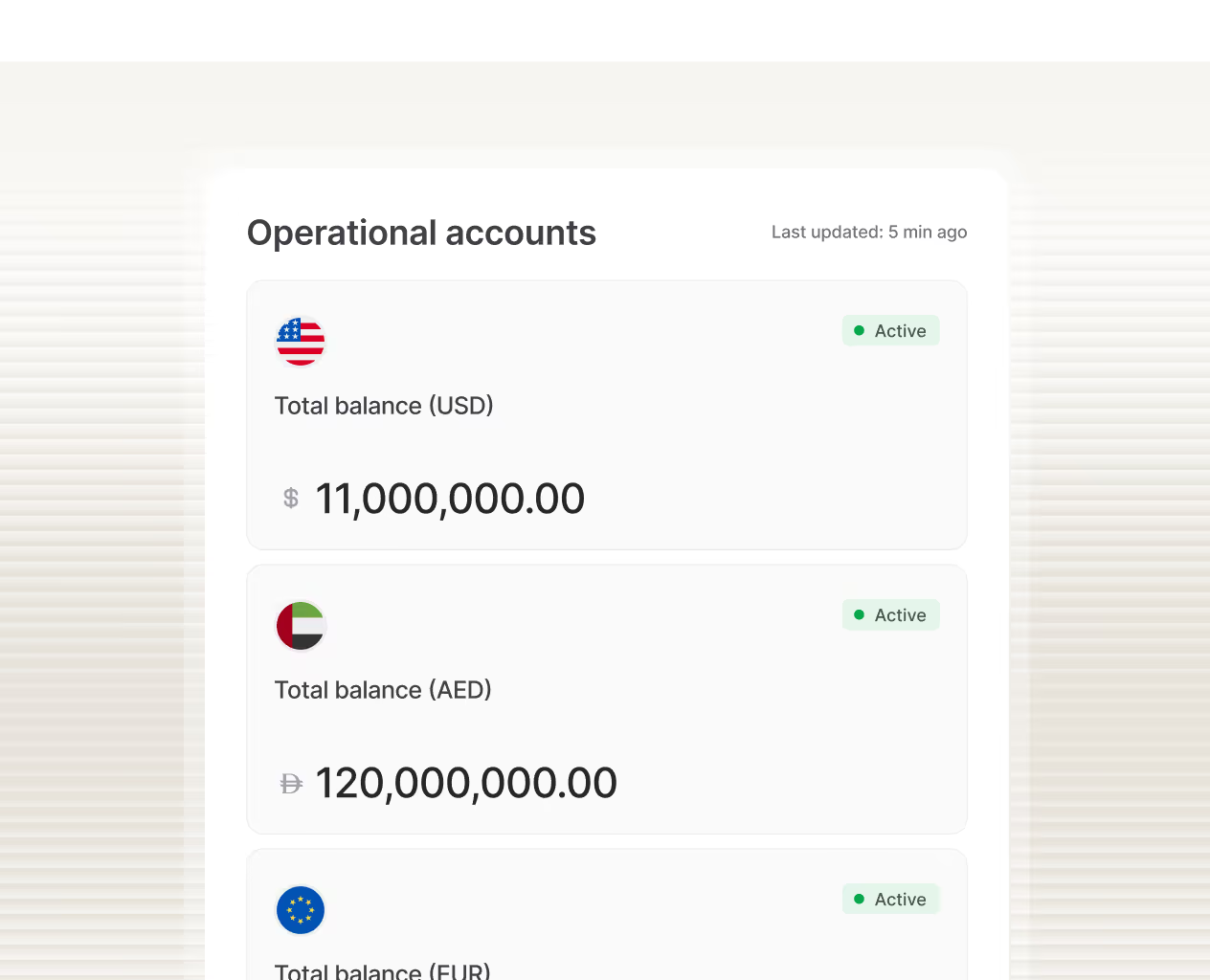

Operational accounts

Run treasury and prefunding for each program.

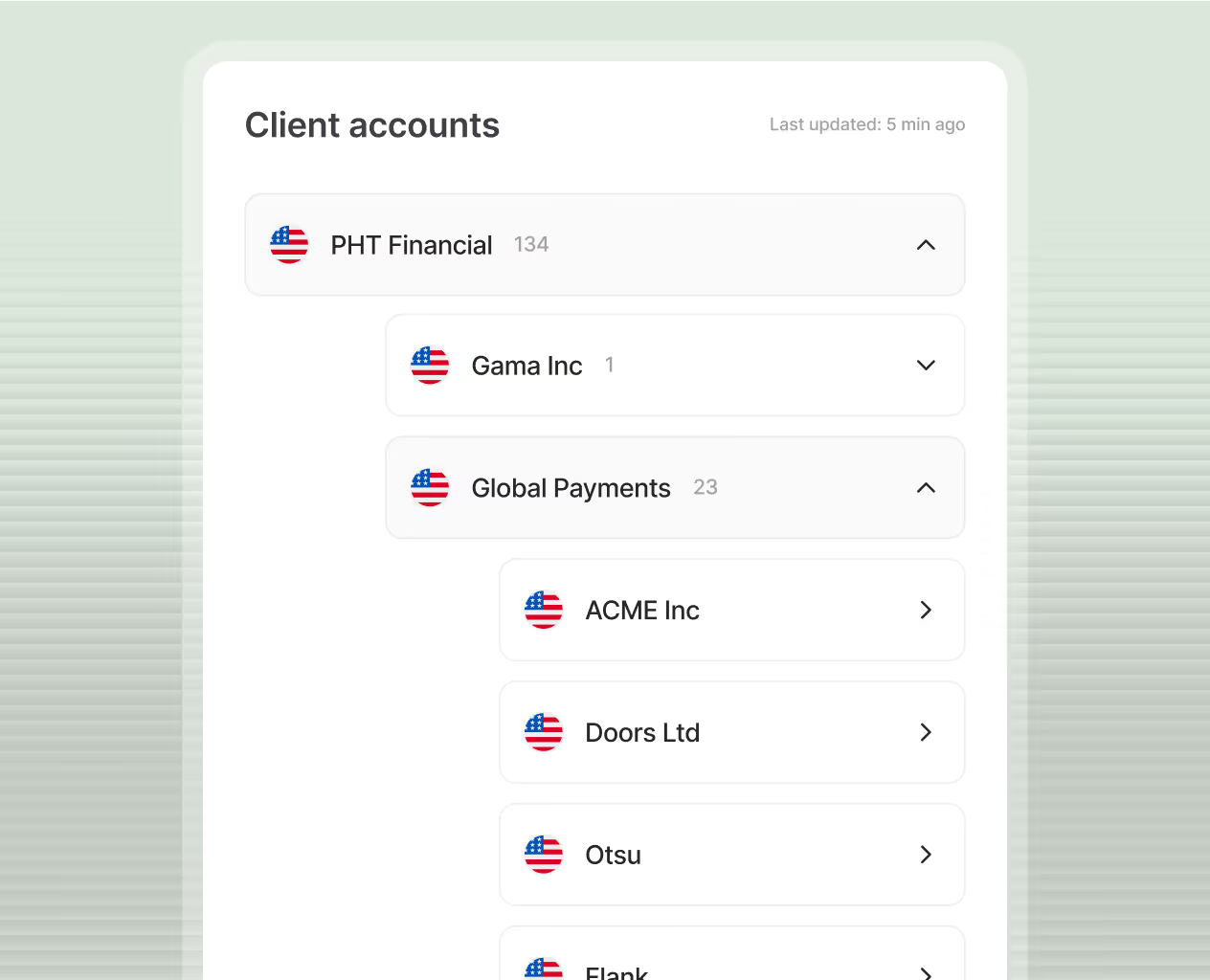

Client master accounts

Hold safeguarded client money with clear oversight.

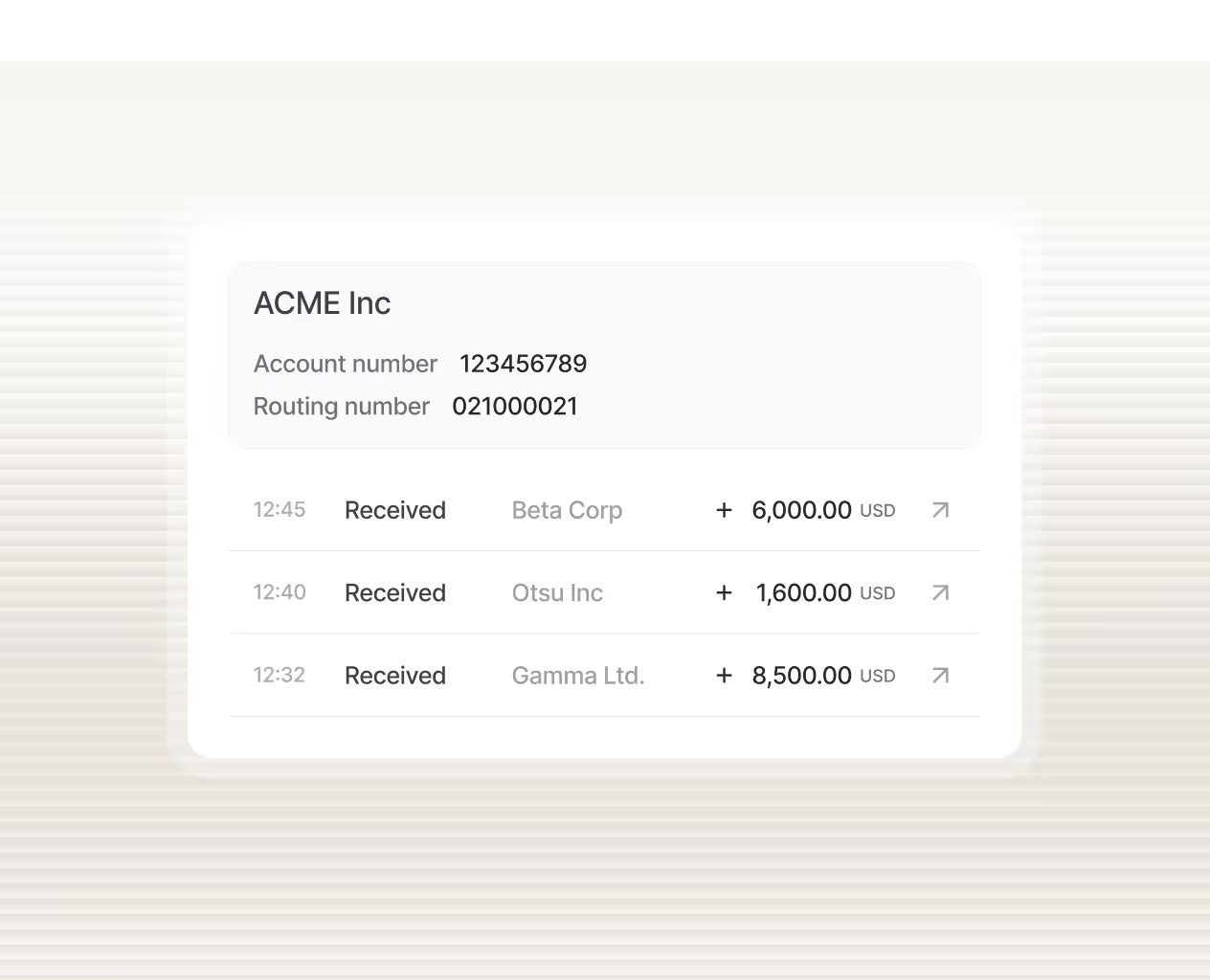

Named customer accounts

Attribute funds to each end customer and keep balances segregated.

Escrow structures

Support conditional settlement for defined platform flows.

Integration and controls

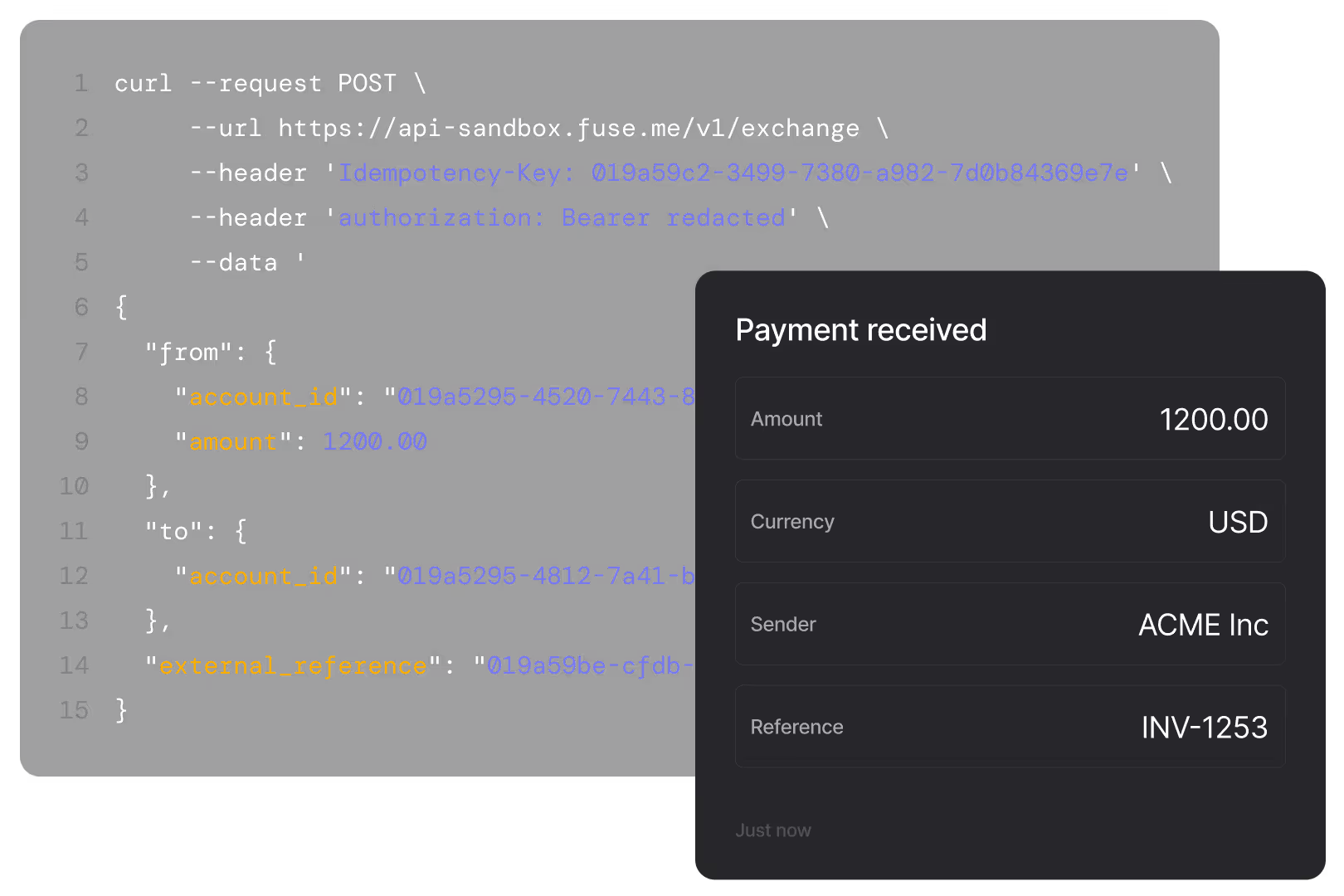

Single API surface

Issue accounts, move funds, and pull reporting through one integration.

Sandbox and rollout

Test end-to-end flows before go-live, then launch in phases.

Permissions and audit trails

Control access by role and keep a full record for finance and ops.

Enter new markets with speed and certainty

FAQs

Yes. USD accounts support the relevant local and cross-border routing formats for clearing and attribution.

Yes. Issue named accounts at scale, aligned to your program structure.

Yes. ACH and Fedwire are supported rails for USD flows.

Use account-level attribution plus references and webhook updates.

Yes. Add currencies as your program expands.